Defining value, intelligence, and opportunity before execution.

This article is a part of The AI Product Lifecycle series – a field guide to building AI products from strategy to execution. Each piece in this series focuses on a specific phase of the lifecycle and the decisions that matter most at that stage.

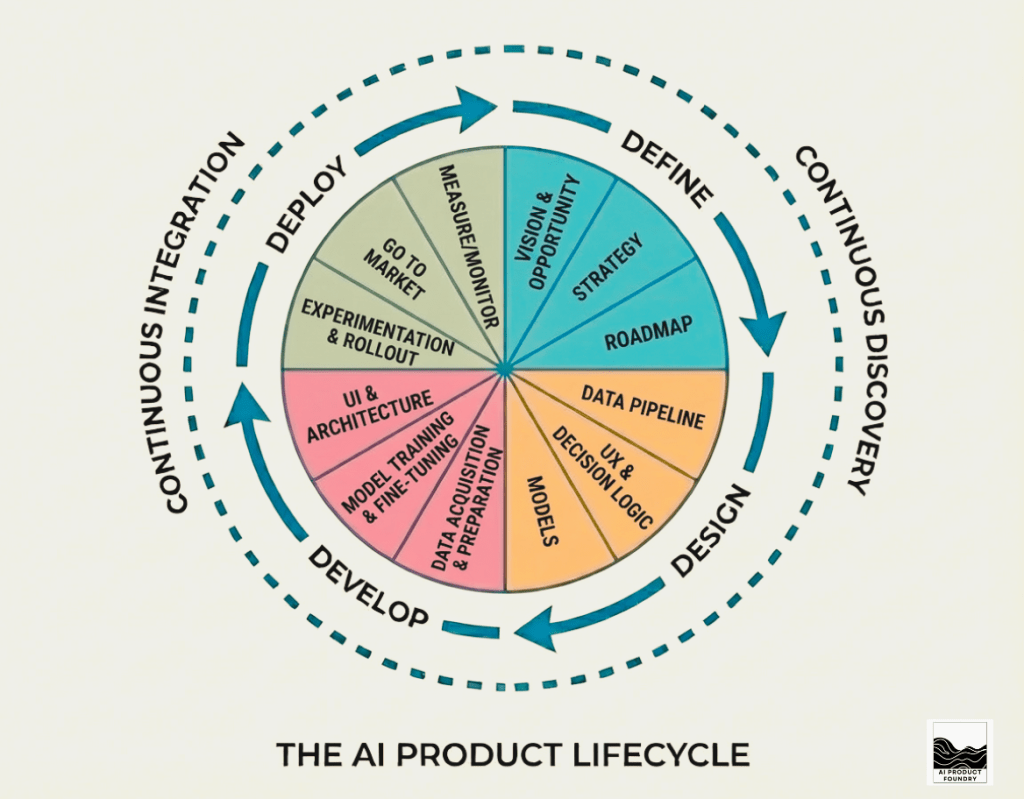

The AI Product Lifecycle

The AI Product Lifecycle defines the iterative process from opportunity definition through continuous integration.

Most teams reach for data, models, and infrastructure before they have clearly articulated what the system is supposed to decide, what trade-offs it should optimize, or how value is expected to materialize for users and the business. As a result, many AI products ship with impressive technical components but unclear impact.

The AI Product Lifecycle reframes this work as a sequence of distinct phases – from defining the problem and intelligence, to building, deploying, and learning in production. Each phase requires its own tools, artifacts, and ways of thinking.

The Blueprint introduced in this post sits within the Define phase of the AI Product Lifecycle where teams translate validated problems into coherent AI product strategy before any models are built or systems are designed.

In This Guide

Part I: Why an AI Product Blueprint?

Part II: The Blueprint – a structured walkthrough

Part III: Applying the Blueprint – a personal finance AI product example

Part IV: Blueprint best practices

PART I: Why an AI Product Blueprint?

Do any of these scenarios sound familiar?

- You’re a Product Manager whose boss just asked you to bolt AI (read: chatbot) onto your product because that is the next big thing, only to soon realize that the Finance team is seeing red (literally).

- You’re an executive who has heard great things about AI, understand its potential and have a strong intuition for where it can be integrated into your business, only to find your team in a bind during implementation.

- Or you’re leading innovation and know something has to change, yet you remain skeptical because too many AI efforts feel directionless, fragile, or impossible to commercialize.

If any of this resonates, there’s a good chance you’re asking, “Is there a better way to do this?” The good news is, there is! Everyone’s still figuring this out and you’re not alone; except now, you have the AI Product Blueprint to help with what most teams struggle with (hint: it’s not the complexity of AI but their product strategy that isn’t designed for AI).

The AI Product Blueprint was born out of the frustrations of product managers and AI practitioners who found a vast disconnect between the strategic vision that was handed down to them and the realities on the ground that couldn’t trace it to success. More common today, with the recent explosion of genAI on the scene, is everybody scurrying to add AI somewhere, catching the low hanging fruits or worse, the wrong fruits altogether, prompting the need for “there must be a better way”. Yet in other cases, there are brilliant innovative ideas that go so far as demos but commercializing them turns into a nightmare (because expectations were not aligned). Or unaware, many teams are resorting to building a veil of a strategy that is primarily comprised of tactical plans to implement AI. The sad truth is that AI IS different, and traditional product strategy frameworks and business planning fall short of the needs of the hour.

You see, traditional product strategy frameworks were built for deterministic, human-driven systems. They often collapse customer problems, solution ideas, differentiation, feasibility, and execution assumptions into a single narrative. That shortcut worked when products behaved predictably. AI products break that shortcut. When value comes from learned behavior, probabilistic judgments, and repeated decisions, ambiguity becomes failure prone. Furthermore, AI is expensive and introduces unpredictable cost structures. Decisions can get costly. But value can be scaled exponentially when done right, which makes it all the more necessary to spend time thinking about this.

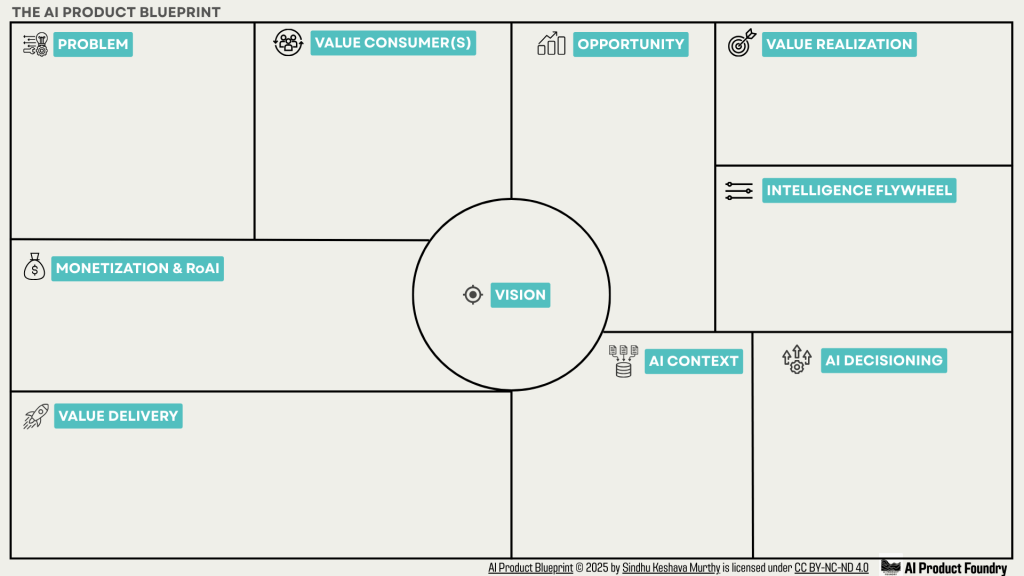

This blueprint deliberately decomposes what is usually labeled “product strategy” into a set of explicit, sequential commitments: the problem worth solving, the value at stake, the outcomes that define success, the operational decisions required to realize that value, and the specific role AI plays in producing intelligence that cannot exist otherwise. It is thoughtfully designed to bake AI right into the product strategy discovery stage without stealing away from the core focus, which is your customers, your business and the value exchange between the two. The goal is not to add process, but to remove ambiguity so that teams don’t mistake technical possibility for strategy or confuse an AI capability with a viable product. The blueprint, once completed, arms you with sufficient clairvoyance to move forward and sufficient confidence to pivot when needed. It’s here not to remove uncertainty, but to make uncertainty more manageable.

That is why the AI Product Blueprint exists today. Used as a strategy discovery framework, the Blueprint guides you to ask the right questions. Used as an artifact, the completed Blueprint functions as a one-page snapshot of your AI Product Vision & Strategy, aligning cross-functional teams and inspiring innovation. You wouldn’t build a house without a blueprint; so should you not build AI without the AI Product Blueprint!

PART II: Blueprint Walk Through

Now that you’ve seen there’s a need for structured AI product strategy formulation, we’ll use this section to explore the blueprint together. Let’s dive in!

How to Read the AI Product Blueprint

The AI Product Blueprint is a strategy design framework, not a checklist. Each block builds on the previous one, moving from customer value to intelligence design, and finally to business impact. The canvas should be read clockwise starting from the left top corner but filled iteratively. The Vision keeps you focused as you navigate strategy discovery.

Below is a walkthrough of each block, its strategic role, and the kind of thinking it is designed to surface.

—

1. Problem

Strategic Responsibility

Define the real problem worth solving. Before AI, before solutions, before product ideas.

This block exists to anchor the entire blueprint in lost value, not technical possibility.

Core Strategic Question

What pain, inefficiency, or value leakage exists today that is severe enough to justify intervention?

Key Considerations

- What concrete pains, frictions, or risks exist today?

- How frequently do they experience it or how severe is it?

- Where is value being lost: time, money, accuracy, trust, opportunity?

- How do people cope with this problem today? What alternatives or workarounds already exist?

- Why are those alternatives insufficient, brittle, or unsustainable?

“AI does not create value by being intelligent; it creates value by reducing real-world pain.”

—

2. Value Consumer(s)

Strategic Responsibility

Identify who experiences and evaluates the value created by solving the problem.

This block prevents the common mistake of designing for a user while monetizing, or optimizing, for someone else.

Core Strategic Question

Who ultimately consumes the value created, and how do they recognize it?

Key Considerations

- Who is the primary user facing the problem?

- What are their characteristics, constraints, and incentives?

- Who else is affected downstream or upstream in the value chain?

- What KPI, metric, or unit of value matters most to each consumer?

- What would the ideal future state look like if the problem no longer existed?

This block often reveals multi-sided value dynamics that AI products must navigate explicitly.

—

3. Vision

Strategic Responsibility

Articulate an aspirational future state that aligns problem and value consumers, without referencing solutions, features, or AI.

The vision is a directional anchor, not a design spec.

Core Strategic Question

What better future becomes possible if this problem is solved well for these consumers?

Key Considerations

- What fundamentally changes in the world if this succeeds?

- What remains true regardless of how the solution evolves?

- What does “better” mean from the consumer’s perspective?

- What is intentionally not included in this vision?

- How does this vision constrain future decisions?

“A strong vision survives technology shifts; a weak one collapses into features.“

—

4. Opportunity

Strategic Responsibility

Translate the problem and vision into a credible business opportunity.

This block connects strategic intent to economic reality.

Core Strategic Question

Why is this problem worth solving at scale, and what is the magnitude of the opportunity?

Key Considerations

- How many value consumers from block 2 face this problem?

- What is the size of the value that can be impacted?

- What portion of that value could realistically be captured?

- What revenue potential exists?

- What business goal does solving this problem advance?

This is where intuition meets numbers. Not to predict perfectly, but to avoid self-deception.

—

5. Value Realization

Strategic Responsibility

Define what “value” actually means in this context and the conditions under which it materializes.

This block answers what must be true in the business or user’s reality for the product to be considered successful.

Core Strategic Question

What outcomes define success, and what must be true for users to experience those outcomes?

Key Considerations

- How are we defining “value” in observable terms for our value consumers? Is value financial, operational, experiential, or risk-based?

- What does a valuable interaction or cycle look like?

- What must users trust, adopt or believe for value to exist?

- Where does value break down if assumptions fail?

- What risks or bottlenecks could prevent value from being realized?

“AI products fail when value exists on paper but not in lived experience.”

—

6. Intelligence Flywheel

Strategic Responsibility

Identify the decisions, insights, or actions that must occur repeatedly to translate value into reality.

This block bridges value and intelligence and explains why AI belongs here at all.

Core Strategic Question

What must the business, system or user be able to know, decide, or act on — repeatedly — for value to be realized and compound over time?

Key Considerations

- What knowledge, decisions or insights must be created, inferred, or calculated to trigger value-driving actions?

- What dependencies or constraints make manual or heuristic solutions challenging?

- What timing constraints exist (early vs late intervention/surfacing of intelligence)?

- How does this improve outcomes for users?

- How does it compound value for the business?

“Without a flywheel, AI is a feature. With one, it becomes a system.“

—

7. AI Decisioning

Strategic Responsibility

Define the specific AI outputs required to power the intelligence flywheel and their limits.

This block makes probabilistic systems safe for real products.

Core Strategic Question

What decisions or predictions must AI produce to enable the intelligence flywheel?

Key Considerations

- What outputs or predictions are required that creates the intelligence in the Intelligence Flywheel?

- What type of AI will give us a strategic advantage?

- What level of accuracy, latency, or error is tolerable?

- What happens when AI is wrong? What is the fallback or fail-safe strategy?

- Where must humans remain in the loop?

Users pay for outcomes, not for intelligence — especially probabilistic intelligence.

—

8. AI Context

Strategic Responsibility

Define the data and inputs required to make AI decisioning viable and defensible.

This block prevents teams from discovering data constraints too late.

Core Strategic Question

What context does the AI need to perform its role effectively?

Key Considerations

- What data inputs are required?

- Where does this data come from?

- Does the data exist in the format needed today?

- How will data be accessed, continuously updated, and governed?

- What constraints or risks exist around data availability?

“AI strategy without data strategy is wishful thinking.”

—

9. Value Delivery

Strategic Responsibility

Design how AI outputs translate into real-world action and differentiation.

This block connects intelligence to experience.

Core Strategic Question

How does AI-driven value reach users in a way that changes outcomes?

Key Considerations

- How are AI outputs surfaced to users? How will the AI outputs be reconciled with real world outcomes?

- What do the new interactions, workflows and behaviors look like? Which users are impacted by this?

- What business processes need to adapt?

- Why is AI the best way to deliver this value?

- Why is this solution delivering value compared to the competition or alternatives? How is it different?

Delivery is where most AI products quietly fail.

—

10. Monetization & RoAI

Strategic Responsibility

Ensure the product is economically sustainable at scale, given the unparalleled imbalance in fixed and variable costs in AI products.

This block forces realism about costs, pricing, and returns on AI investment.

Core Strategic Question

How does this AI product make money – directly or indirectly – and does it hold up at scale?

Key Considerations

- What is the cost per prediction or decision?

- What is the revenue or value per prediction?

- Is the unit RoAI economically justified? How does RoAI change with volume?

- Where do costs grow non-linearly?

- How strategically defensible is the value and hence this RoAI?

“AI that cannot scale economically is not a product; it’s a demo.“

In summary, the AI Product Blueprint is a structured way to define an AI product’s vision and strategy by explicitly linking a real customer problem to measurable value, the intelligence required to realize that value, and the role AI plays in producing it. It starts by clarifying the problem, the value consumers, and an aspirational vision, then quantifies the opportunity and defines what “value realization” actually means in practice. From there, it identifies the intelligence levers (the recurring decisions, insights, or actions that must exist for value to materialize) before mapping those needs to concrete AI decisioning, the data and context required to support it, and the way outputs are delivered into real workflows. Finally, it closes the loop by making monetization and return on intelligence explicit, ensuring the product’s business model scales in proportion to the quality of intelligence it delivers. Together, these blocks form a one-page articulation of AI product strategy, independent of specific models, architectures, or execution choices, which are later derivatives of this blueprint.

To make the AI Product Blueprint concrete, let’s look at how this might apply to a real-world product example in the next section.

PART III: Applying the Blueprint – A Personal Finance AI Product

This is an illustration of applying the blueprint to a real-world example – a personal finance product that actively helps users stay on track with their savings and budget goals, even when life throws unexpected expenses their way.

This is intentionally not a simple budgeting, tracking, or forecasting tool. Those already exist, and they largely fail at what users actually struggle with – recovering after plans break. This example shows how the blueprint applies to an AI product that continuously recalibrates decisions in response to real-world uncertainty – the kind of problem AI is uniquely suited to address.

Below is how a product team may complete the blueprint in its first draft.

Product: Adaptive Personal Finance Coach

Goal: Help users consistently meet savings goals without forcing rigid budgeting or lifestyle sacrifices, even under unexpected expenses.

—

1. Problem

Core problem

“I want to save, but real life keeps derailing me.”

People intend to save and manage money responsibly, but unexpected expenses force users into reactive decisions without support, causing cascading failures across budgets and savings goals, leaving them financially stressed and worse off.

Concrete pains & frictions

- Budgets and savings plans are static, while expenses are irregular and unpredictable

- Unplanned expenses (medical bills, emergency travel, repairs, income timing gaps, or even impulse purchases and lifestyle changes) derail monthly plans

- Users must make emotionally loaded trade-offs mid-month with little guidance

- Existing tools surface problems after damage is done (“You overspent”) rather than helping recovery

Where value is lost

Money: directly and indirectly. Small deviations accumulate, leading to materially lower annual savings, and fees, interest, or missed financial opportunities that compound over time

Time: repeated manual re-planning, reallocation, or starting over

Trust: users lose confidence in both the plan and the budgeting tool

How users cope today

- Manually shifting categories or pulling from savings

- Accepting the month as “failed” and disengaging

- Reducing spending indiscriminately without understanding trade-offs

- Abandoning the budgeting tool altogether

Existing alternatives & workarounds

- Budgeting apps (e.g., Simplifi, YNAB): rigid category-based planning, reactive alerts

- Bank dashboards: descriptive reporting, no decision support

- Spreadsheets: high effort, low adaptability

- Generic advice (“cut dining out”) disconnected from context

Why these are insufficient

- They assume financial failure is due to lack of discipline or visibility

- They focus on retrospective tracking, not real-time decision support

- They do not help users continuously re-balance plans when reality changes

- Manual adaptation is cognitively taxing and unsustainable over time

Bottom line

Users don’t fail because they don’t track or plan spending — they fail because they lack support to continuously adapt financial decisions when life disrupts the plan.

—

2. Value Consumers

Primary value consumer (core user)

- Individuals actively budgeting and saving, primarily in the age range 18-50

- Includes both:

- people with tight or fixed monthly constraints

- people with discretionary spending power who still intend to save

- Digitally connected to bank and card accounts

- Financially aware, but overloaded by day-to-day decisions

- Disrupted by:

- unexpected expenses

- impulse purchases

- lifestyle changes

Secondary / downstream consumers

- Households managing shared or interdependent finances

- Financial institutions (B2B2C) seeking:

- higher engagement

- improved retention

- stronger financial health outcomes

User characteristics & constraints

- High intent to manage money responsibly

- Limited tolerance for constant re-planning

- Emotionally impacted by money stress, regardless of income level

- Vulnerable to plan breakdown when reality deviates from expectations

What value means to each consumer

- Primary user:

- consistent progress toward savings goals

- fewer painful trade-offs mid- or late-month

- reduced end-of-month panic

- ability to make “good enough” decisions quickly

- feeling in control, not surprised

- Secondary consumers:

- more stable financial behavior over time

- reduced churn and higher trust in financial tools

Primary unit(s) of value

- % of savings goal achieved

- Total amount saved over time

- Budget adherence without late-month shortfall

- Reduced financial stress (proxies):

- fewer overdrafts

- fewer emergency reallocations

Ideal future state

- Users hit savings goals more often or save more overall

- Progress continues despite unplanned expenses

- Plans adapt instead of collapsing

Users feel guided rather than restricted, and their budgets and savings dynamically adapt to reality. The user experience shifts from constant vigilance to confidence:

“I can absorb surprises and still make progress toward my goals without constantly thinking about money.”

Outcome: sustained savings with lower cognitive load

—

3. Vision

Aspirational vision (one line)

Less of people adapting to their finances, and more of finances adapting to people.

OR,

Making financial management enjoyable, frictionless and possible for people with any savings budget and goal.

What fundamentally changes if this succeeds

Financial planning becomes resilient instead of fragile. Life events, impulse decisions, or unexpected expenses no longer cause plans to fail; progress continues even when reality deviates from expectations.

What remains true regardless of how the solution evolves

Users should not need rigid discipline, constant attention, or repeated re-planning to stay on track. Financial systems should absorb volatility, so users don’t have to.

—

4. Opportunity

Market & users

- Digitally active, bank-connected users: ~200M globally

- Users actively budgeting but failing intermittently: ~80 –100M

Value at stake per user per year

- Missed savings: $1,000 – $5,000

- Fees, interest, emergency borrowing: $150 –$2,000

- Total potential impact: ~$1,150 – $7,000 per user per year

Conservative capture assumptions:

Realistic improvement: 10–20% of value at stake (users can recover $100–$1,400/year depending on circumstances)

Applying to ~100M users → $10B–$140B in total financial impact globally and value field to operate in

Business relevance

- Subscription retention: reducing churn in our high-turnover personal finance app

- Differentiation: continuous value drives engagement, not just onboarding novelty

- Expansion: creates a foundation for premium services or financial wellness offerings

Bottom line

Helping users stay on track even during unplanned expenses addresses a global, multi-billion-dollar opportunity, impacts tens of millions of users annually, and advances both consumer financial health and business growth.

—

5. Value Realization

Value is realized when users can recover from unplanned financial events without sacrificing desired lifestyle choices or experiencing stressful trade-offs. Success depends on detecting plan deviations early, dynamically recalculating feasibility of savings goals, and giving users actionable recovery options that preserve intent rather than demand perfection.

Key indicators of value:

- Monthly savings goals met more consistently

- Budgets adhered to without rigid restrictions

- Unexpected expenses no longer derail financial plans

- Decision confidence improves

How value is realized:

1. Deviations are detected before overspending occurs

2. Trade-offs are made consciously, not reactively

3. Plans are rebalanced dynamically to reflect real-life changes

4. Guidance is trustworthy, actionable, and flexible

5. Users experience progress without micromanaging spending

Assumptions for value to exist:

- Users adopt and trust the guidance

- Spending adjustments are timely and actionable

- Recovery options align with long-term goals while preserving short-term flexibility

Where value can break down / risks:

- Guidance is ignored or delayed

- Feasibility calculations are inaccurate

- Recommendations feel restrictive or punitive

- System fails to reconcile long-term goals with short-term reality

In short:

The product acts as a dynamic constraint balancer between goals, time, and spending – something static budgets cannot do.

—

6. Intelligence Flywheel

To realize the value described in the previous block, the system must continuously generate intelligence that guides decisions before plan deviations escalate. Value is only realized if the system can repeatedly detect deviations, interpret constraints, and trigger adaptive actions. Static rules or manual heuristics cannot keep up with dynamic spending patterns, changing flexibility, and user preferences. Intelligence must evolve as the user’s situation evolves.

Key intelligence (what should the product or business know in order to help the user realize value)?

- Trajectory awareness: understand where the user is headed, not just their current state. Determine if current spending still allows savings goals to be met

- Know which budget categories can flex without long-term harm

- Know and determine how to reallocate budgets in ways the user is likely to accept

- Decide when to intervene and when to hold back

Why repeated intelligence is essential:

- Context and flexibility change daily or hourly

- Each cycle of [observation → interpretation → rebalancing] improves accuracy

- Static logic cannot anticipate evolving trade-offs or user responses

To maintain financial health under uncertainty, the system must continuously reconstruct the user’s feasible financial reality as conditions change. That requires repeatedly creating intelligence that does not exist naturally.

Flywheel dynamics (compounding over time):

Each cycle improves:

Accuracy of flexibility windows

Timing of interventions

User adherence to guidance

Richer feedback → more precise intelligence → increasingly effective future cycles

—

7. AI Decisioning

To operationalize the Intelligence Flywheel, AI must produce decisions and predictions that generate the intelligence the system relies on. These outputs enable repeated, context-aware interventions while leaving ultimate control to the user. Humans remain accountable, and AI provides decision support, not enforcement.

Core AI decisions and predictions

- End-of-Month Feasibility Index: probability that savings and budget goals can still be met, based on current balances, remaining income, obligations, and historical variance

- Category Elasticity Modeling: learning how much each spending category can flex without triggering user rejection or rebound overspending

- Optimal Budget Reallocation: computing recommended adjustments (ΔBudget_i) that restore feasibility while minimizing “pain cost” under hard constraints (e.g., rent)

- Intervention Timing Decision: determining whether to surface guidance now, later, or not at all (silence is a valid decision)

AI types enabling these outputs:

- Machine Learning (ML): predictive modeling for trajectories, elasticity, and trade-offs

- Large Language Models (LLMs): translating abstract goals into contextual guidance and interpretable recommendations

- Reinforcement Learning / Adaptive Systems: optimizing timing of interventions based on observed user behavior and feedback loops

Mapping to Value Realization:

| Value Realization Goal | AI Decision That Enables It |

| Avoid missed savings goals | Feasibility Index |

| Preserve lifestyle | Category Elasticity |

| Recover from shocks | Optimal Budget Reallocation |

| Maintain long-term trust | Timing Decision |

Key considerations for AI:

- Accuracy and latency must support timely, actionable guidance, though small deviations are tolerable if fallback exists

- Fallback / fail-safe strategies: human-in-the-loop review, optional override, or conservative defaults

- AI predictions are continuously updated from user behavior, reinforcing the compounding flywheel

—

8. AI Context

To perform its role effectively, AI requires a combination of real-time financial data, user-defined preferences, and behavioral feedback. This context allows the system to continuously assess feasibility, model flexibility, and optimize interventions, while enabling the compounding intelligence flywheel.

Required data inputs:

- Financial transactions: bank and credit card transactions via open banking APIs or aggregator platforms (e.g., Plaid, Yodlee)

- Account balances and pending charges: accessed via direct API connections or secure tokenized integrations

- Income deposits and timing: payroll or recurring income feeds through bank APIs

- User-defined goals and constraints: savings targets, budget limits, and discretionary categories captured in-app

Derived signals:

- Fixed vs discretionary spend: inferred from transaction categorization and historical patterns

- Spending volatility: variability in timing and amounts of recurring or unplanned expenses

- Behavioral compliance history: adherence to past recommendations and budget allocations

Feedback loops:

- Accepted vs ignored recommendations

- Manual overrides

- Month-end outcomes vs projections

Strategic advantage:

- Temporal insight: understanding how behavior evolves over time

- Personalization compounding: recommendations improve as AI observes repeated responses

- Continuous data refresh: real-time API access ensures dynamic, up-to-date intelligence

Constraints and risks:

- Availability of bank/credit APIs varies by region and institution

- Data may be delayed, incomplete, or inconsistently formatted

- Regulatory, privacy, and security requirements (e.g., GDPR, PSD2) must be strictly enforced

- Access depends on user consent and token refresh cycles

—

9. Value Delivery

AI-driven value reaches users by enabling immediate, actionable recovery rather than attempting to predict or control behavior. The system continuously recalibrates financial plans post-transaction and provides realistic, personalized options, surfacing guidance at moments where intervention has maximum impact. Users are empowered to make informed trade-offs, while the system learns from choices to improve future decision support.

How value is delivered:

- Post-transaction, pre-damage: interventions immediately after unexpected expenses

- Mid-cycle recalibration: reassessing feasibility and providing recovery options within the current budget period

- Decision windows: targeted guidance around key triggers, such as:

- Paycheck arrival

- Large or unplanned expense detection

- Rapid category burn-rate acceleration

User interactions and workflows:

Clear, realistic options are presented, e.g.:

Option A:

Reduce shopping $430,

delay one weekend outing $200,

switch 3 cab rides to metro $170

Option B:

Cut one big night out $600,

reduce or opt for more cost-effective food delivery $300

Options are simulated. The user chooses. The system adapts and learns. This is just faster re-computation than humans can manage, and recommendations are personalized and contextual, not generic cuts or alerts.

Business process and product differentiation:

- Continuous, AI-driven recomputation replaces static rules or manual budgeting

- Focuses on recovery rather than prevention — traditional tools only report or suggest generic cuts

- Learns personalized budget elasticity and delivers decision support only when meaningful

AI is essential to effectiveness and defensibility because it enables:

1. Real-time recomputation

2. User-specific guidance

3. Explicit, constrained trade-offs that static systems cannot produce

Competitors tell users what happened or what might happen. This product tells users what to do next, with tradeoffs made explicit and constrained by reality. That shift, from insight to decision support, is the core differentiator and is what is made possible by an AI product strategy.

—

10. Monetization & RoAI

This block answers whether the AI intelligence layer generates returns that justify its cost at scale. To keep this example simple, we’re going to choose a freemium subscription monetization model, where AI continuously delivers decision support to each user.

To better answer this block’s key questions, we’re going to define a unit prediction.

Unit definition: 1 paid user = 1 “prediction”

- AI may generate many micro-decisions per user/month

- Costs are aggregated per user to measure efficiency and ROI

Revenue model:

Subscription: $8/month ($96/year) per user

(Quick calibration using existing apps such as Simplifi and RocketMoney)

Adoption assumptions (conservative):

Free users: 1,000,000

Conversion to paid AI tier: 5% → 50,000 paid users

Annual revenue: 50,000 × $96 ≈ $4.8M

AI & data cost structure (annual):

Intelligence & Inference: ML forecasting, anomaly detection, selective LLM usage for explanations and re-planning

- LLM invoked only when confidence thresholds are met

- Cost per paid user per month: $0.50 (rough estimate based on current market pricing and number of LLM calls/inferences) → 50,000 × $0.50 × 12 ≈ $300,000/yr

Data access & infrastructure: bank/credit aggregation, transaction normalization, feature pipelines, cloud hosting → $400,000/yr

AI engineering & marketing (model dev, evaluation, distribution, improvement): $800,000 → ~$16/user/year

Total AI-related cost: $1.5M → ~$30/user/year

Unit economics (per prediction unit / user):

Revenue: $96/year

Cost: $30/year

Gross margin: $66/user (~69%)

Scaling implications:

- Costs grow sublinearly with more users

- Shared inference pipelines and selective LLM calls amortize cost

- Fixed engineering and operations costs spread over more users

Example: 200,000 users → revenue $19.2M, AI-related costs ~$6M, gross margin ~$13.2M (~69–70%)

Gross margin improves as fixed costs are diluted and AI efficiency increases

Strategic defensibility:

- Continuous learning and personalization make the product sticky and differentiated

- AI provides always-on recovery guidance, which competitors rarely deliver.

- Subscription pricing is predictable and psychologically safe, supporting sustainable adoption. Customers are buying peace of mind and cognitive convenience, just like with insurance products, where paying a small price upfront helps them save big later on.

IN Closing: Why This Example Matters

This example illustrates what the AI Product Blueprint is designed to do: separate intention from implementation, value from technology, and intelligence from novelty. Nothing here depends on a specific model or interface. What matters is the logic of value creation, the necessity of adaptive intelligence, and the discipline to define AI’s role precisely. The same blueprint applies whether you are building consumer apps, internal tools, or enterprise platforms!

We use a personal finance scenario not because it’s the most important problem, but because it exposes a pattern that appears everywhere: when value depends on continuous feasibility under uncertainty, intelligence, not rules, becomes the product.

PART IV: Best Practices

Here are some best practices for using the AI Product Blueprint.

1. Use the Blueprint to Shape Strategy, Not Simply Document It

The canvas should surface unanswered questions and hard trade-offs and avoid simply capturing what is already known. If everything feels obvious, the team is not pushing deep enough.

—

2. Fill It Iteratively, Not Sequentially

Teams should expect to revisit blocks multiple times. Insights in AI Decisioning may reshape Value Realization. Constraints in AI Context may alter Opportunity assumptions. Monetization modelling may uncover new value and revenue opportunities flipping a red NPV to a green one.

This iteration is the point.

—

3. Keep AI Out of the Early Blocks

The first half of the Blueprint should read like strong product strategy, even if AI were removed. If the problem and value are not compelling without AI, AI will not save it.

—

4. Be Precise Where It Matters Most

Precision is critical in:

Value Consumer(s)

Intelligence Flywheel

AI Decisioning

Vague intelligence leads to vague products.

—

5. Treat the Blueprint as a Go / No-Go Gate

It is acceptable (and expected) for some ideas to fail the Blueprint. The framework is designed to filter weak AI applications early, before execution costs are incurred.

—

6. Derive Execution Artifacts After, Not During

The Blueprint is not the roadmap, architecture, or PRD. Those artifacts come after, once strategic clarity is achieved.

A final thought

AI is deceptively difficult: building a model is often easier than delivering value. Experienced ML teams know that most failed AI projects weren’t technically wrong – they were solving the wrong problem or weren’t measuring the right decision outcomes. This blueprint is designed for the upstream decisions that determine whether an AI product deserves to exist. Engineers, ML practitioners, and PMs will find it helps protect their work from being wasted, while giving leadership confidence to invest in the right initiatives.

Leave a comment